Travel insurance is a must-have for any traveler looking to take a voyage on the high seas. It provides an extra layer of security and coverage in case of injury or illness while onboard your cruise (and even before you leave). Cruise travel insurance can also cover missed connections, lost luggage, trip cancellations and more.

What does travel insurance cover when you cruise?

Travel insurance typically covers a variety of risks associated with cruising, such as trip cancellation and interruption based on a covered reason, such as inclement weather, medical expenses if you get sick onboard or in port, reimbursement if your luggage doesn’t make it to the ship, and more. With the right insurance for you, specifically with Faye, you can be covered both before and during your trip.

Reasons why you need travel insurance while cruising

Travel insurance is essential when going on a cruise or any other trip, as it protects you from some of the unexpecteds. Here are some of the most common reasons why people choose to protect their cruises with travel insurance:

- Regular health insurance may not reach beyond U.S. borders. Even if you’re just doing a few days in the Caribbean, it’s unlikely your U.S. health insurance will cover you if you need medical assistance.

- Traveling to and from the ship carries its own risks. If you’ve got flights to catch and bags to lug on board, then there is always an added element of risk that something can go wrong, so thinking ahead and protecting every leg of your journey is helpful.

- Emergency medical evacuation can be expensive. If something serious happens, you want to be able to get home quickly. Under certain circumstances, this is not a cheap endeavor, it could cost tens of thousands of dollars.

- Weather is a force to be reckoned with. During hurricane and typhoon season, you can book a cruise at excellent rates but may experience extreme weather that can impact your trip. Hence why protecting yourself and your trip investment is recommended.

Tips for finding the best cruise travel insurance

Doing your research can help when looking for travel insurance for your cruise. Once you identify the plans you are considering, reach out to the customer support team at those companies to confirm the coverage they offer and to see how quickly they respond. You should also take the time to read online reviews, as previous customers can provide valuable insight into their experience and help you make an informed decision when selecting a provider to protect your trip.

Consider additional benefits and add-ons that are relevant to your trip, such as Cancel For Any Reason (in case you may need to nix your plans) or Adventure & Extreme Sports Protection (for any thrilling sea or port excursions). Finally, make sure to look into pre-existing medical condition coverage, if needed, before purchasing a plan. With Faye specifically, when you purchase your plan within 14 days of the date of your initial trip deposit is received and are medically able to travel when you purchase your plan, pre-existing conditions can be covered (just like any other illness).

Safely sail away with Faye

Faye plans provide travel coverage and care for U.S. residents who are traveling domestically within the U.S. and internationally – including on cruises!

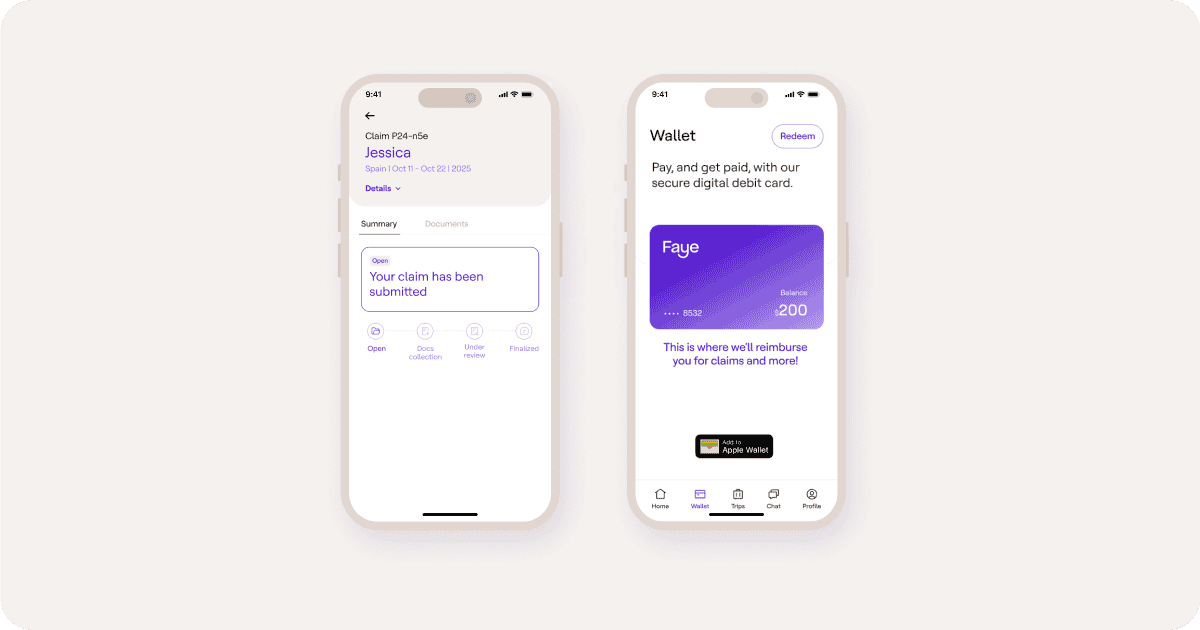

With Faye, keep your vacation afloat with protection for your trip, health and stuff, and 24/7 support. We provide cruise protection that covers the following:

- Up to $500k for medical emergency evacuation and repatriation

- Up to $250k for emergency medical expenses (Int’l)

- Up to 100% of your non-refundable trip costs for trip cancellation

- Up to 150% of your non-refundable trip costs for trip interruption

- Up to $300/day, and a max of $4,500 per trip for trip delays

- And more

Protect your next voyage away from home with cruise travel insurance to get much-needed protection and peace of mind, ensuring you are covered before, during and after you set sail.