We see you, thrill-seekers.

For the adrenaline junkies, free divers and bungee jumpers, we’ve got your extreme lifestyle covered with our newest travel protection add-on: Adventure & Extreme Sports Protection.

What is adventure travel insurance?

Adventure and extreme sports are thrilling due to their high risk nature. If paragliding through the Swiss Alps, climbing Mount Everest or free diving in the Caribbean are at the top of your bucket list, then you need travel insurance that protects you to the fullest during your trip.

Faye’s add-on includes medical coverage* if you become injured while participating in such activities. Specifically, Faye can cover up to $250K (international trips) or $50K (domestic trips) in accident and sickness expenses, as stated in your plan, to cover injury from adventure and extreme sports on the same basis as all other injuries.

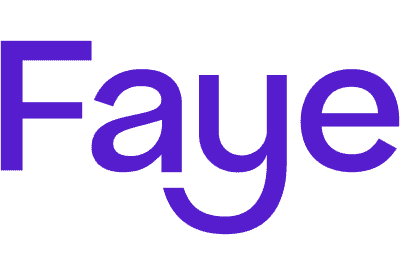

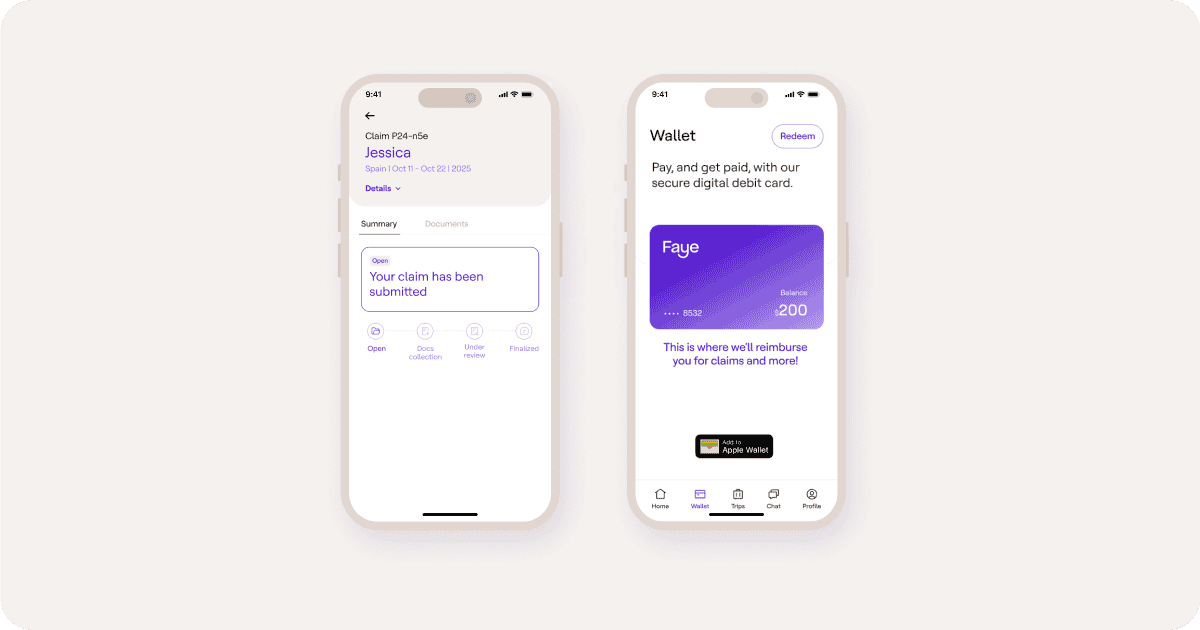

In addition to coverage, Faye provides around-the-clock assistance – whether it’s finding an extreme activity to book, or if you need support when something goes awry. Access our team of customer experience experts via the Faye app chat function, so you can enjoy having a safety net in your back pocket while you go all in on action.

Which adventure sports are covered?

We don’t want you to purchase additional coverage that you don’t need, so know that Faye’s base plans (sans any add-on) already comes with non-extreme sports and activity coverage for the more mild-hearted travelers who love surfing by day, hiking at sunset and dancing the night away (plus much more).

Our Adventure & Extreme Sports add-on is specifically for the action addicts who seek that extra level of intensity. It covers:

- B.A.S.E. jumping

- Bull riding

- Running of the bulls

- Free diving

- Bungee jumping

- Hot air ballooning

- Parachuting

- Skydiving

- Cliff diving

- Fly-by-wire

- Paragliding

- Hang gliding

- Heli-skiing

- Heli-snowboarding

- Wingsuit flying

- Rock climbing without equipment (Free soloing)

- Bodily contact sports

- Mountain climbing over 9,000 feet (2,700 meters)

- Motorsport or motor racing

- Multi-sport endurance competitions

- Parkour

- Scuba diving if the depth exceeds 131 feet (40 meters)

- Any activity materially similar to the above

What about my gear?

We don’t just protect you – we’ve also got your sports equipment covered. If your sports gear gets lost, stolen, damaged or destroyed during your trip, you can be reimbursed for up to $2,000. This is included under the baggage and personal effects coverage with all Faye plans, so it applies even if you do not purchase the Adventure & Extreme Sports Protection add on. Check out our full list of coverage here.

Go near. Go far. Go BIG. With Faye.

Life is too short to sweat the small stuff, to stick too close to home and to let those items on your bucket list fall to the wayside. So if you feel the urge to jump out of that plane, or run with those bulls, do it knowing we’ve got you covered.

Losses due to, arising or resulting from Adventure or Extreme Activities are normally excluded from coverage. However, for an additional cost, you can purchase a plan that does not contain this exclusion, so that such losses due to, arising or resulting from Adventure or Extreme Activities are covered on the same basis as losses due to, arising or resulting from all other injuries.