As you pack your bags and dream of exotic destinations, understanding your healthcare coverage is as crucial as remembering to bring your passport. You, along with many other American seniors, may wonder about medicare coverage while traveling abroad. We’ve unpacked some highlights of what Medicare can cover and how to make sure you’re protected every step of the way.

Do I need travel insurance if I have Medicare?

The short answer: Yes. Even if you’re covered by Medicare at home, it’s important to consider purchasing travel insurance when you travel abroad. According to Medicare.gov, health care you get while traveling outside the U.S. usually isn’t covered. There are some exceptions to this that we will outline for you on the when, where and why of Medicare travel coverage.

Medicare coverage beyond U.S. borders

For the most part, Medicare offers very limited coverage for international travel. In most scenarios, Medicare won’t cover health care or supplies that you receive outside the United States, including prescription medication. However, there are a few exceptions for globe-trotting seniors:

1. In Canadian or Mexican proximity: If you’re traveling between Alaska and another U.S. state through Canada, or you’re closer to a Canadian or Mexican hospital than a U.S. one during an emergency, Medicare may cover your treatment.

2. On a cruise ship: Medicare may cover medical services you receive on a cruise ship, provided the ship is in a U.S. port or no more than 6 hours away from one when you receive help.

3. U.S. territory treatment: If you receive medical treatment in U.S. territories (Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and the Northern Mariana Islands), Medicare may provide coverage.

Medigap supplemental insurance

For broader coverage, you can turn to Medicare Supplement Insurance, also known as Medigap. Certain Medigap policies may offer coverage for travel outside the U.S., covering 80% of the charges for certain medically necessary emergency care when abroad. It’s important to note that this coverage comes with limitations:

- Lifetime limit: There’s a $50,000 lifetime limit, which might not fully cover extensive medical treatments.

- Foreign travel emergency coverage: This coverage usually only applies during the first 60 days of your trip and comes with a $250 deductible.

Considering Medicare Advantage

Medicare Advantage Plans might offer additional coverage for international travel, but the benefits and coverage limits vary significantly on a plan to plan basis. If you’re considering this route, it’s important to contact your plan provider directly to understand the specifics of your international coverage.

Here’s a quick cheat sheet for understanding your Medicare coverage.

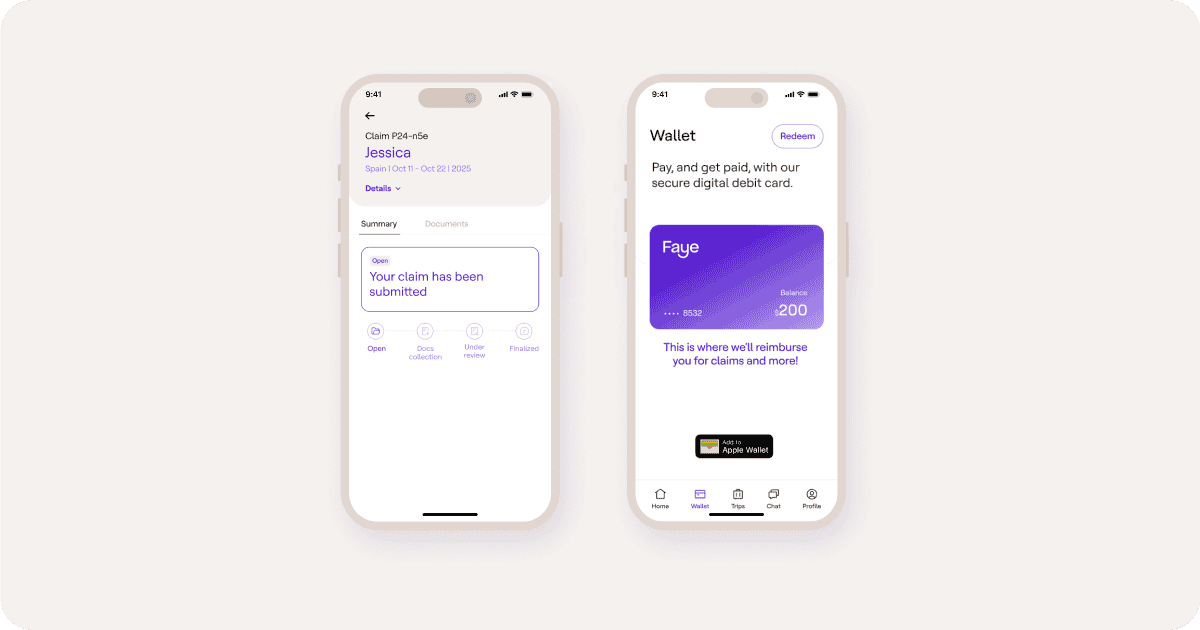

Travel insurance that’s there 24/7

Given the limitations of Medicare coverage for trips outside the U.S., purchasing travel insurance can be beneficial for seniors planning to travel abroad. Travel insurance, like Faye, can provide robust coverage for medical emergencies, including situations not covered by Medicare or Medigap policies. Plans can also cover emergency medical evacuation, trip cancellation and delays, and more, offering extra peace of mind for your adventures. Take a look at what’s included in a Faye Travel Protection plan, including 24/7 assistance from our team.

Explore safely with Faye by your side

Traveling internationally in your golden years can be a first-class experience. To make sure you’re prepared, understand how to best cover yourself in case things go wrong. While Medicare can provide limited coverage for international travel, investing in travel insurance can help ensure you’re protected to the fullest while you’re out exploring the world at your own speed.

Have questions? No problem – call us at +1-833-240-7056 so we can help you determine if a travel protection plan is right for you.

Remember, the world is vast and beautiful, but your health and safety should always come first and Faye’s got your back when it comes to both.

Information about Medicare, Medigap, and Medicare Advantage comes from Medicare.gov. We recommend you visit that website to learn more.