Travel insurance is sometimes viewed as that forgettable add-on to protect parts of your trip, but in reality, it’s a must-have advantage that can cover your whole trip – from your flights to your stuff and your health – even before your trip starts. Here at Faye, our travel insurance and assistance can protect every aspect of your trip, no matter if you’re heading on a long weekend getaway or looking for a lavish escape.

And with many feeling confused about what the heck travel insurance actually includes, we’ve compiled a list of common misconceptions to stop your head from spinning and set the record straight.

Myth: “I should only purchase travel insurance if my trip is expensive”

Reality: No matter how much you spend on your upcoming adventures, delayed flights and lost luggage can happen to anyone. In fact, mishandled baggage doubled globally in 2022 alone.

We all know someone with a less than ideal story of going on vacation and landing with their luggage nowhere to be found – which isn’t the surprise we want (c’mon, we want a free room upgrade). Mishaps of all sizes happen and ones like this are exactly why you need coverage, no matter the cost of your trip.

During the purchase process with Faye, you can adjust your estimated total trip cost along with your destinations and the size of your travel party – and then we provide a custom price and coverage plan. This means you can protect those short staycations and your month-long getaways.

Myth: “I don’t need travel insurance; my health insurance covers me.”

Reality: This misconception is thrown around quite a bit. But, it’s important to know that most health insurance providers do not fully cover illness or treatment when you’re abroad or even out of state. And what about your flights, hotels, bags and pre-paid activities? They definitely don’t cover those.

Faye travel protection is built to cover your health needs. We are even there if you get sick pre-trip and need to cancel or change your plans. In such a case we can cover your non-refundable trip expenses – your health insurance likely cannot.

To make a well-informed decision about whether or not you should purchase travel insurance in addition to your health insurance, call your health insurance provider and ask them the following questions about their coverage:

- Does my plan cover emergency expenses abroad such as bringing me back to the U.S. if I become seriously ill?

- Do you require pre-authorizations or second opinions before emergency treatment can start?

- Can you guarantee medical payments abroad?

Myth: “My credit card will protect my trip”

Reality: Some credit card companies include various travel protections but in comparison to whole-trip travel insurance, the benefits are limited.

To receive reimbursements you must book everything on your credit card, and though some inconveniences can potentially be reimbursed based on which card you have (such as lost baggage and roadside assistance), you may have to wait a while to see the refunds.

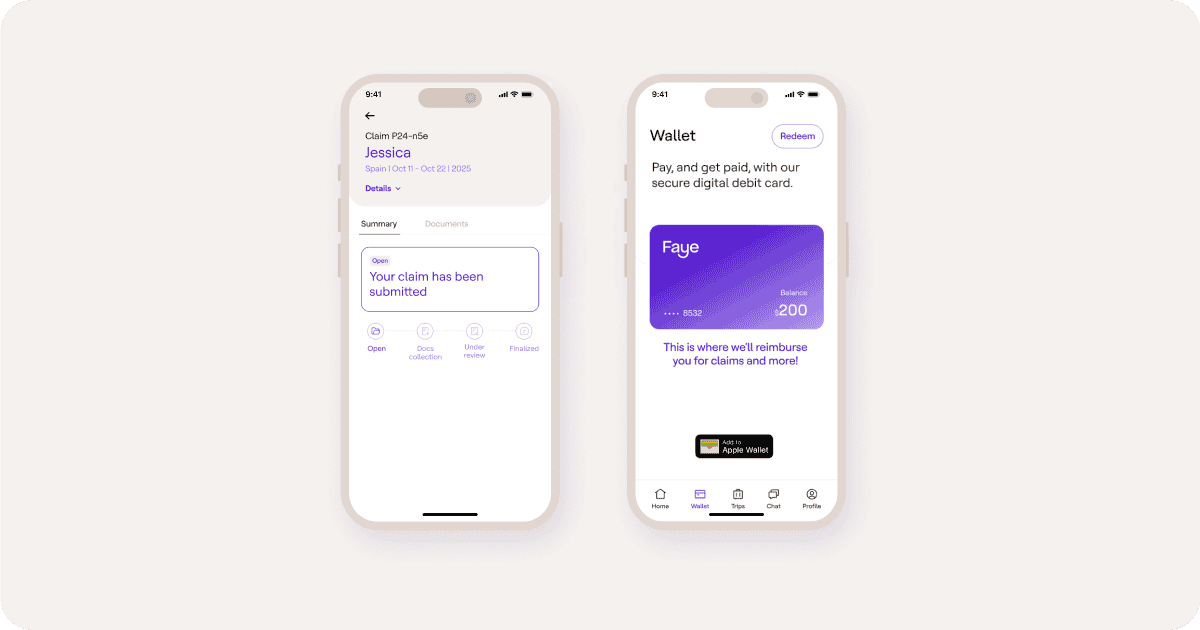

Faye can reimburse you quickly on claims directly to Faye Wallet. Not to mention, our coverage protects you in emergency-related scenarios (such as national disasters or political security evacuations) whereas credit card providers typically do not.

Myth: “I’m flying domestically, and I only need travel insurance for an international trip”

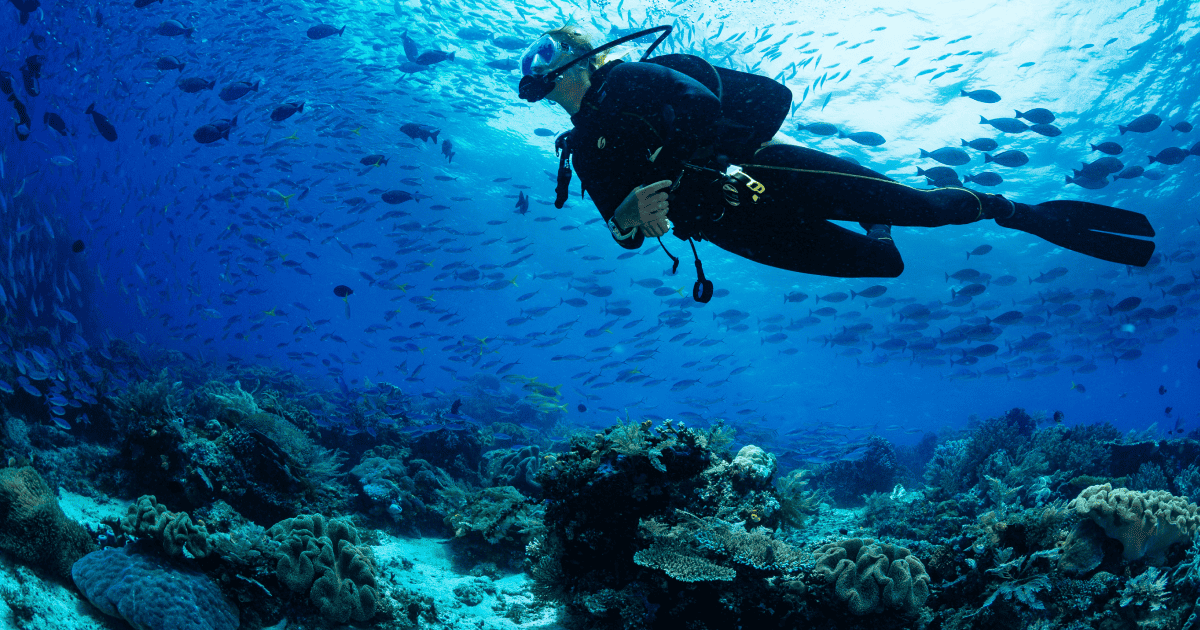

Reality: Anyone traveling domestically or internationally can benefit from travel insurance as it can cover unexpected events resulting in medical emergencies, cancellations or interruptions – all of which are important considering the current state of travel worldwide.

So if you’re honeymooning in Hawaii, going on a water ski trip in Big Bear, California or planning to snowboard in Colorado, best to be protected as accidents can happen anywhere.

Myth: “I can just get covered if something happens in real-time on my trip”

Reality: You can’t purchase Faye while already in-trip and if you want to reap all the benefits, make sure you secure your travel insurance before you leave for your trip. By doing so, you give yourself ample time to carefully review the policy details and are able to get all your needs covered (CFAR and our pre-existing medical conditions waiver are only available when you book your insurance within two weeks of your initial trip deposit). It’s like giving yourself a safety net for any potential risks that may arise during your travels or even before you leave.

A great advantage of having travel insurance is the coverage it provides if something unexpected happens before or during your trip. Whether it’s getting sick, injuring yourself or facing any other unforeseen circumstances that prevent you from traveling, Faye allows you to cancel your trip for these reasons.

Go with Faye

Whether you’re going near or far, staying in hostels or 5-star hotels, travel insurance should always be “packed” safely in your carry-on (or simply via our app). Enjoy peace of mind with travel coverage and care that goes the distance to protect you. Check out our coverage and protect your upcoming adventures.