When you jump on a plane to the Caribbean or road trip across the outback in Australia, you’re looking for an adventure without the worries of what could go wrong. With proper travel coverage those worries should fade away, but does your credit card provide the coverage you need to explore carefree?

Some credit cards have notable travel coverage, and some just insure the bare minimum. Discover what’s what when it comes to travel insurance vs. credit card travel protections.

What you need to know about travel insurance vs. credit card travel coverage

The first rule of travel coverage, no matter what you choose, is to make sure you know what you’re getting. Is emergency medical covered? What about trip delays? And how about lost bags, flight delays or missed connections?

Understanding what travel coverage your credit card offers – yes we mean the fine print – and being able to compare that to the travel insurance policy you might be considering is crucial. Then you can compare and contrast what’s the best option for you. For example, if you have a pre-existing medical condition, it’s super important to know you’re covered when away from home.

Pros and cons of credit card travel protection plans

There are many options when it comes to choosing a credit card, but most credit cards that offer travel protection are going to cost you an annual fee. That said, you typically won’t have to shell out anything for the travel protection that comes along with it. In many cases, depending on the card, you don’t need to inform the company of your upcoming adventure; as long as you pay for everything related to the trip with your card, the protection plan is automatically active.

However, there are very few credit cards that cover the full range of what a dedicated travel insurance plan protects. In fact, emergency medical expenses and emergency medical evacuation are two areas that are rarely covered by credit card plans. Some do cover inconveniences like lost baggage or roadside assistance. Knowing these limitations and that it may take a while to see reimbursements from your card company is important.

Example of credit cards with travel protection

Based on reviews, some of the top cards to consider that offer trip protection are Chase Sapphire Preferred® Card, Chase Sapphire Reserve® and The Platinum Card® from American Express. They all come with a hefty annual fee up to $695.

If you’re not going far, and not taking a plane, then your credit card might be enough. But if you’re flying domestically or internationally, plan to stay in a vacation rental or partake in extreme sports, you should think twice about solely relying on your credit card.

Benefits and disadvantages of travel insurance

Just like with credit card coverage, not all travel insurance is created equal. Some travel insurance companies offer fancy-named coverage packages that don’t protect your entire trip. When shopping for a plan, coverage benefits to look for include – emergency medical expenses, medical and non-medical evacuation as well as lost luggage, flight delays and cancelations.

Travel insurance today should offer comprehensive coverage essentially providing more protection than what your credit card offers and then some. And though you’ll have to pay for a policy, in the long run, if something goes awry, you’ll save yourself (and your wallet) the headache should you end up in an emergency situation.

Something worth noting is some travel insurance providers don’t cover your pre-existing medical conditions or offer Cancel For Any Reason (CFAR) coverage. Faye covers both as long as you book your travel coverage within 14 days of your initial trip deposit and are physically able to travel.

What does Faye cover?

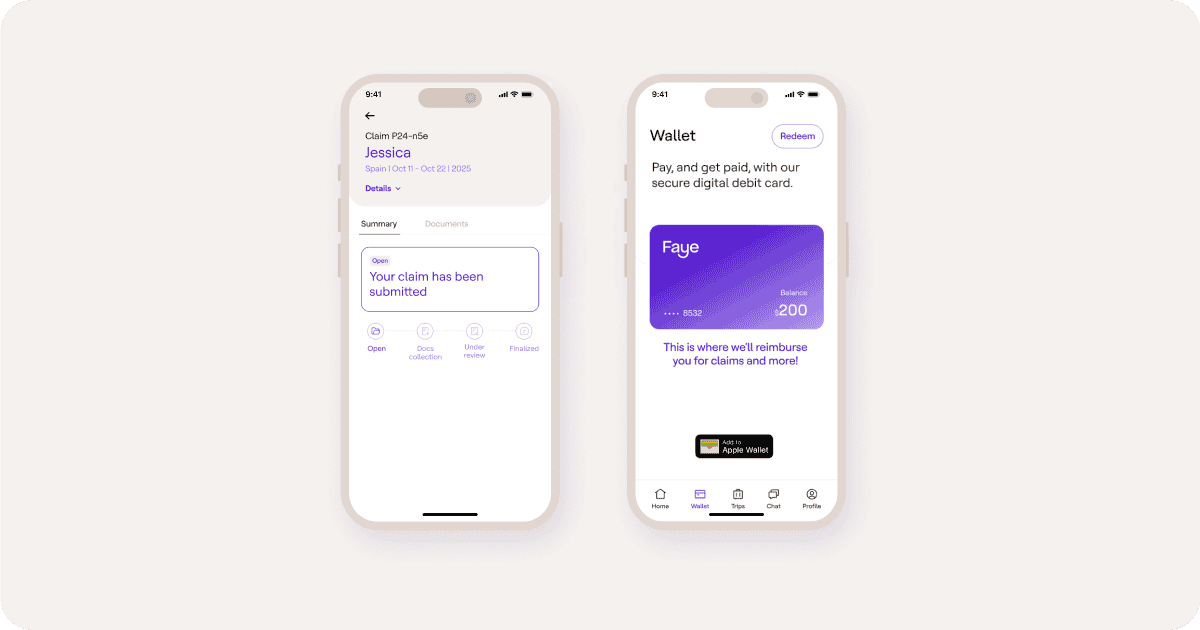

Faye is whole-trip travel insurance that covers your health, your trip and your stuff. For a breakdown of everything that’s included in our protection plans – check out our what’s covered page, where you can also find a full policy there to read before you buy.

And something that sets us apart from the rest – and any credit card company – is our 24/7 support team, made of real people ready to help with any question or concern you may have even before you purchase – from activities to book to urgent care locations to nearby ATMs while in-trip.

Making the right choice

There is always a long list of to-dos as you prep for your next adventure. So here’s some friendly advice – don’t leave travel coverage for the last minute, put it at the top of the list. If you have a dedicated travel credit card, check the coverage in advance to decide if it’s enough for your specific trip and if not, remember Faye’s there for you 24/7 for your coverage needs.